DEPENDENT ON TRUST: Is it so dangerous if inequalities increase and confidence in politicians decreases? Yes, because we are facing major economic austerity measures in the transition to the green shift, and after the corona crisis. The government is therefore dependent on the citizens’ trust and perception of justice, the submitter writes.

Zero taxpayers show as much ingenuity in aggressive tax planning as in the development of new products and jobs. It is bad social economics and it weakens democracy.

OPINION by Ingjerd Terese Skaug Robin,

a socially engaged lawyer,

from original first published in Norwegian in Dagbladet

translated by Ailin Terese Salbu for Bergensia

Trump pays less in taxes than a cashier at Walmart. Apple pays 0.005 percent in taxes to Ireland. In Norway, the number of zero taxpayers has increased explosively.

The Nicolai Tangen case and DN’s article on the exemption model’s billion-dollar hole have put the spotlight on the ethical and legal aspects of creative tax planning.

The tax debate is important because tax revenue is the state’s most important source of revenue. Reduction leads to less money for infrastructure, research, and education, on which a well-functioning business community depends. Silos of Art and sculpture parks from rich philanthropists are not sufficient.

Navigating to tax havens and loopholes is not illegal, but it is ethically problematic. Loopholes occur by mistake because the legislature is not able to predict all conceivable scenarios. In the area of tax law, legal certainty and predictability are important, and it is ensured by-laws being drafted as simply as possible with the main rule, without too many complicated and detailed exceptions.

In this process, loopholes can arise, both tax lawyers and their clients know this well. They have earned billions from Google, Facebook, Amazon, and Apple, being able to withdraw profits from accounts in the Cayman Islands, even if the values are created in Norway.

The legal basis is an outdated international tax regulation from 1920 which is used contrary to its intention.

An example of a Norwegian loophole is the exemption model. It saw the light of day when the tax law was changed in 2006 on the initiative of the then Minister of Finance of the Conservative Party, Per-Kristian Foss. The purpose of the amendment was to create tax incentives for growth and jobs, at the same time as it was proposed to remove capital gains tax on dividends, which were reinvested in joint-stock companies.

When the exemption model came into force in 2006, several thousand business owners set up their own holding companies in order to receive a tax-free dividend from the business of a private holding company. The richest increased their personal fortunes by 90 billion tax-free kroner in 2019 due to this rule according to Dagens Næringsliv. It represents almost half of the State’s total oil revenues in 2018 of 208 billion.

Using the exemption model, Stein Erik Hagen transfers billions from Orkla to his private holding company Canica, which has now emigrated to the tax haven Switzerland. The cash flow from Aker goes to Kjell Inge Røkke’s holding company The Resource Group. The tax-free gain can be used by billionaires to reinvest in real estate, but also shares and mutual funds, which are tax-free. Therefore, the rich’s fortunes are increasing at record speeds in Norway.

According to Aftenposten, Norway now has four times as many rich and twice as many billionaires as the United States in relation to the population. Norway has become a prime example of the French economist Thomas Piketty’s thesis from the book “Capital in the 21st Century” that inequality in the world is growing as a result of the return on capital increases faster than the return on earned income.

The super-rich are hailed by the media who write about cabin palaces, luxury holidays, and private flights. It creates the impression that it is an accomplishment to get away from paying taxes.

A striking bus driver who usually receives his monthly paycheck with an automatic deduction of 35 percent and cannot afford his own home, must undeniably feel a little stupid. While he has to use his taxable income to rent a home in an overpriced market, Petter Stordalen can buy luxury apartments for both daughter and ex-wife through his Strawberry Holding with money that has never been taxed.

The bus driver should ask himself the question of whether the tax system is fair. If it is still a goal that Norway should be an egalitarian society.

The tax system has loopholes and built-in biases that have arisen before the Solberg government took office in 2013. The exemption model is one of them. VAT and the social security tax, which constitute the State’s largest source of income, are different. Because the taxes are flat and therefore the ones with the lowest income are being hit hardest.

Erna Solberg pursues a policy that fortifies these imbalances.

In addition, she goes even further in reinforcing the difference between rich and poor. A difference that admittedly does not appear in the government’s Inequality Report from 2019, because the figures are only based on taxable income, and then the large transfers to the holding companies do not emerge. The map therefore does not match the terrain and the government risks prescribing the wrong medicine.

While the tax burden on wage earners has been stable, the business community has had corporate tax reduction from 28 to 22 percent under Erna Solberg. At the same time, the Conservatives’ national meeting voted this year to remove the wealth tax on working capital in order to strengthen Norwegian ownership and jobs. Despite the fact that studies show that large assets are transferred to private holding companies and reinvested in real estate, which neither leads to more jobs nor economic growth.

Apropos of that, the renowned economist Joseph Stiglitz in Foreign Affairs (Jan./Feb.) Writes that investment in US business fell when President Reagen reduced his wealth tax dramatically in the 1980s.

The Solberg government has also abolished the inheritance tax during her reign, which affects the redistribution of capital for the benefit of those who already have the most. Norway now has a lower tax level for inheritance and gift transfers than the average in the OECD countries. The principle of continuity is then taken into account, which means that the heir takes over the heir’s entry value so that he must tax the value of the heir object.

While the Government distributes carrots to the rich, it uses the whip on the poor. During her reign, Erna Solberg has reduced the economic child support payments for the disabled and removed the right to holiday pay for the unemployed. The free legal aid has also been reduced so that even the NAV victims could not use this scheme when they were deprived of benefits on the wrong basis.

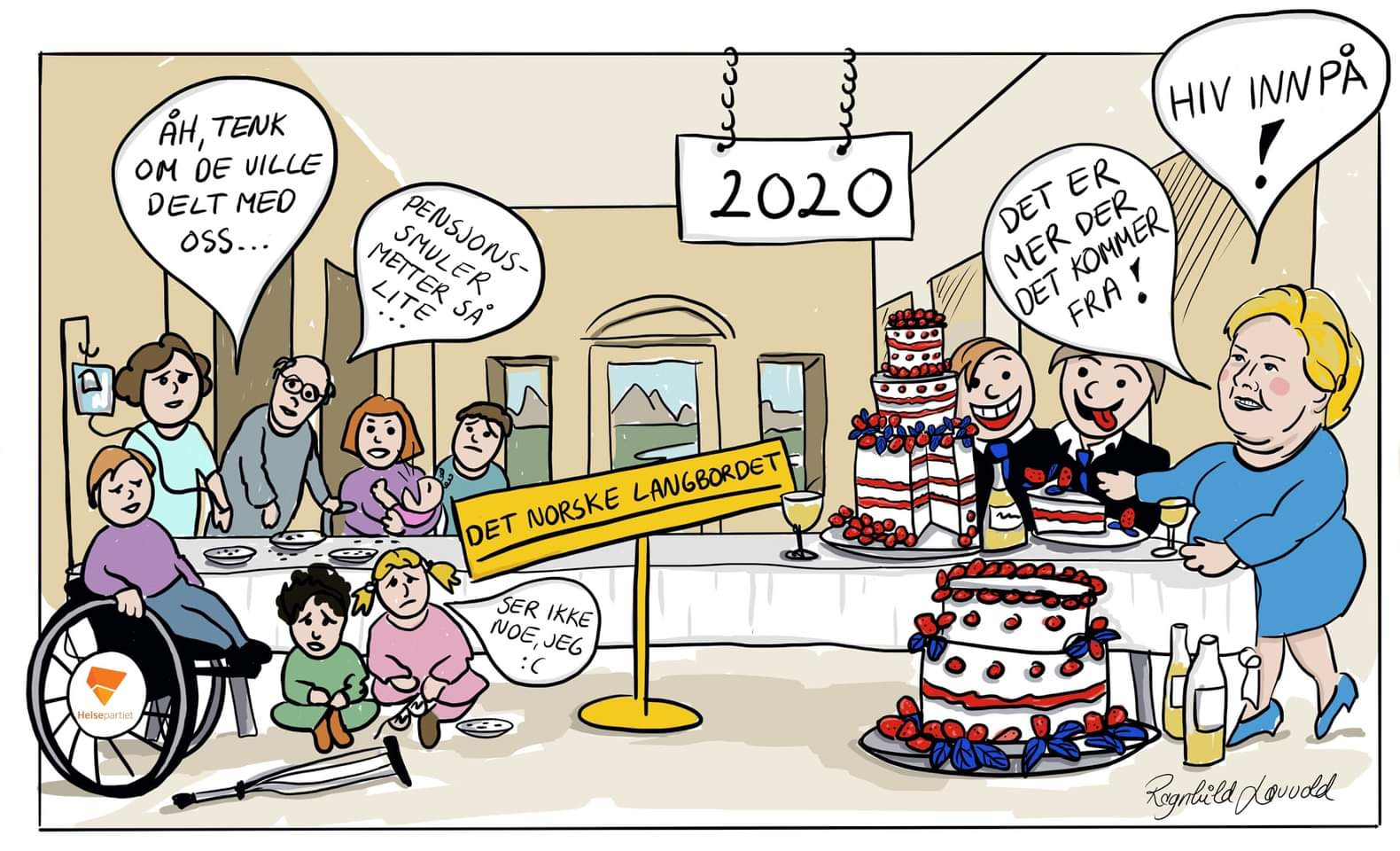

But is it dangerous if inequalities increase and confidence in politicians declines? Yes, because Norway is facing major economic austerity measures in the transition to the green shift and as a result of the corona crisis. The government is therefore dependent on the citizens’ trust and it is based on the citizens’ perception of justice.

In France, the widespread protests from the Yellow West Movement were the result of the citizens’ distrust of politicians, which they believed introduced taxes and duties that only affected ordinary people, while the elite escaped. Contempt for politicians increases in proportion to increased differences, and then democracy weakens. This is dangerous.